Get Started With

servzone

Overview

Trust registration begins with the drafting of a trust deed. Trust deed is the first requirement in the process of trust registration. The trust deed is made on non-judicial stamp paper, with each state setting its own rate on stamp duty. Book an appointment with the trust deed once at the Sub-Registrar's office. All trustees with the trust deed and two witnesses are required to appear before the sub-registrar on the appointment date.

About the Trust

The Indian Trust Act 1882 defines trust as an organization where the owner (trustee) decides to transfer the right of his property to another person called a trustee so that the third person (beneficiary) can take advantage of it .

Such assets are transferred by the trustee to the trustee with a declaration that the trustee should hold the property for the recipients of the trust.

Trust is classified into two categories:

A public trust is created to provide benefits to the public at large, thus in the case of a public trust the beneficiaries are largely public. Public trust is further divided into two parts:

1. Public charitable trust

2. Public Religious Trust

Often families or individuals are beneficiaries in the case of private trusts. Private trust is further divided into two parts:

1. Private trusts whose recipients and their mandatory offers can both be resolved

2. Private trusts whose either or both recipients and their mandatory proposals cannot be resolved

- Public Trust

- Private Trust

12A and 80G certificate

Income tax department issues 12A certificate to the trust or NGO. Any trust that has a 12A certificate is not liable to pay income tax for the entire lifetime on its surplus income.

Additionally, an NGO must obtain an 80G certificate. This certification allows the donor to take advantage of the deduction at the time of donating. Thus, you can say that donors are offered a deduction under section 80G of the Income Tax Act.

Legislation

A trust is represented by the Indian Trust Act, 1882 across India. However, each state has its own Trust Act in its own state with such non & ndash; The benefit may extend to administering organizations.

Further, a trust can acquire assets and activities like a society. Nevertheless, it is very challenging to acquire an asset or enterprise after a trust.

If there is interest in acquiring a fund or project then the trust requires a trust to meet certain eligibility criteria. The criteria can be anything like empirical experience, performance of a trust, its age and other such criteria.

Benefits

The reason behind forming any trust is to be involved in charitable activities as well as to get tax exemption. These charitable trusts are also called non-profit organizations.

A trust should be a legal entity if it wants to get all the benefits of the trust offered by the government. The Trust Act and federal law make it mandatory for such entities to be registered under charitable trusts.

A trust deed is required to register a charitable trust. Therefore, charitable registration is also called a trust deed.

The federal and state law departments in India classify assets for the management of charitable organizations and the common people. This process greatly assists donors who wish to lend their assets to trusts from which they expect trustees to receive full tax benefits.

At the time of charitable trust registration it is essential that you are aware of some basic knowledge related to registration and the fees payable at the time of registration. Explicit laws such as the Trust Act 1882 have been announced, and the application has been endorsed to encourage the process of registration.

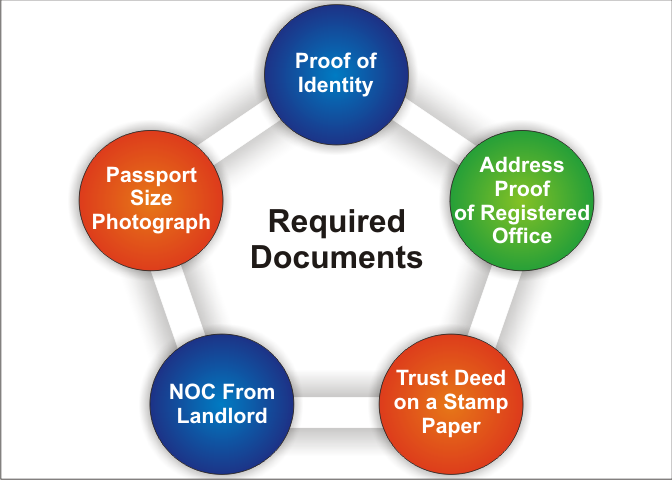

Required Documents

- The trust deed is the primary most important document you will need at the time of trust registration. The trust deed contains the following information:

- The purpose of the trust

- Information of the Settler and trustees like Name, Age, Father’s Name, Address, Occupation, Mobile Number, Email Address, Designation

- Total number of trustees

- Address of the trust's registered office

- Rules and rules that will follow the trust

- Proposed Name of Trust

- A copy of the identity proof of the Settler and the Trustee

- Passport size photo of settler and trustee

- Settler presence with original identity proof and two witnesses at the time of registration. Some states have made the presence of trustees mandatory.

Income tax formalities

Once you have registered a valid trust, the next step for you to follow is to go for 12A and 80G registration so that you can avail the tax exemption. Form 10A is used for filing applications for registration.

In the event where the total payment of a trust or establishment is Rs. 50,000 / - in a year, without giving effect to the provisions of Sections 11 and 12, the trust or foundation records for that year should be inspected. . Chartered accountants or some other speculative organizations are eligible to be selected as appraisers. The audit report should be in Form No. 10B recommended in the Income Rules 1962 and stated that the review report should be scheduled along with the return of income.

Important point for trust registration

- Private vs. Public Trust

Private trusts in India are regulated and regulated by the Indian Trusts Act, 1882, on the other hand public trusts regulate their functioning except in the state of Maharashtra where the Bombay Public Trusts Act, 1950 regulates the functioning of public trusts . is.

- Number of trustees

There is no maximum limit set for the number of trustees, but at least two trustees are always required at the time of trust registration. The trust should make arrangements regarding the administration of the trust with a strategy of handing over or removing members

- Trust Deed Trust registration cannot be done without the most important document called

trust deed. This explains the reason behind the existence of faith. The document also lists its beneficiary and explains the power of trustees. A minimum of two witnesses is required at the time of the deed signing process.

- Tax benefit

Public trusts can enjoy the privileges granted by the government after the registration process. Public trusts are also eligible to avail tax exemption.

Registration process

- Name Selection

Select a unique name for your trust, the name must be new and should not cause any violation.

- Drafting draft

The trust deed must be drafted, with meetings for the deed (creator of the trust deed), trustee, and recipient.

- Trust Registration

A trust deed is a document containing all important information related to registration and must be submitted to the registrar of trusts with jurisdiction.

- PAN, TAN and bank account

The final step in the registration process is to apply for the allotment of PAN number and TAN and later apply for a bank account.

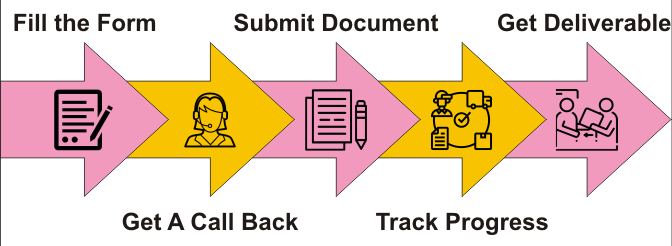

How Servzone will help you?

GST Registration

PVT. LTD. Company

Loan

Insurance